Live site:

ml.aiengineer.work

The Business Problem

Companies face significant challenges with customer churn - customers closing accounts and moving to competitors. Understanding what factors drive this decision allows management to focus improvement efforts where they matter most. My objective is to build a neural network classifier that predicts whether a customer will leave the bank in the next 6 months. The techniques I use below are to measure bank customer churn, though this can be applied to many other industries.

In this notebook, I’ll walk through my process of building, evaluating, and optimizing neural network models to predict whether a bank customer will leave in the next 6 months. This kind of prediction is extremely valuable for businesses as customer retention is often more cost-effective than acquisition.

Model Optimization Strategy:

- Build the Neural Network model with SGD as an optimizer (Model 1).

- Use different methods mentioned below to improve the model by finding the optimal threshold using ROC-AUC curves for each of the methods.

- Build a model with Adam optimizer (Model 2).

- Build a model with Dropout and Adam optimizer (Model 3).

- Build model with Hyperparameter tuning using Grid search and Adam optimizer (Model 4).

- Build a model with balanced data by applying SMOTE and Adam optimizer (Model 5).

- Choose the best model from the ones built for optimizing prediction of customer churn.

TL;DR - Analysis and Conclusion

After building and comparing five different neural network models, I’ve concluded that Model 4 (Hyperparameter Tuning with Adam optimizer) performs the best overall. Here’s why:

- It achieved the highest ROC AUC score of 0.85

- The recall for the churn class (1) is 0.75, which is crucial for this business problem

- The precision-recall balance is better suited for identifying customers at risk of churning

The final classification report for our chosen model (Model 4) shows:

precision recall f1-score support

0 0.93 0.79 0.85 1593

1 0.47 0.75 0.58 407

accuracy 0.78 2000

macro avg 0.70 0.77 0.72 2000

weighted avg 0.83 0.78 0.80 2000While the overall accuracy is 78%, what’s most important here is the high recall (75%) for the churn class. This means our model is quite good at identifying customers who will actually leave, which is what matters most to the business. We’d rather flag some false positives (customers predicted to leave who actually stay) than miss customers who are about to churn.

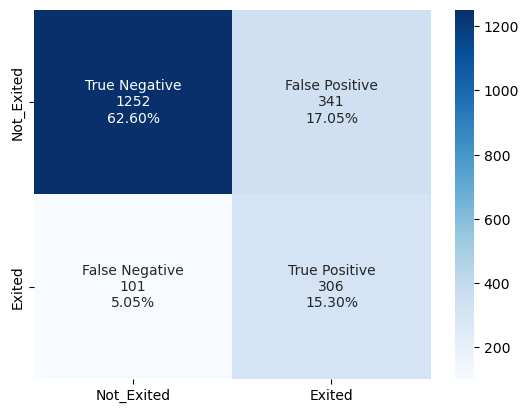

The confusion matrix visually confirms this trade-off, showing that most of our misclassifications are false positives rather than false negatives.

Next Steps for Production Deployment

I would approach productionizing this model as follows:

- Model Refinement:

- Experiment with additional features or transformations

- Try ensemble methods combining multiple models

- Investigate more sophisticated neural network architectures

- MLOps Pipeline:

- Containerize the solution using Docker for consistent environments

- Set up CI/CD pipeline for model training and deployment

- Implement model versioning and A/B testing capabilities

- Monitoring and Maintenance:

- Deploy monitoring for concept drift detection

- Set up automated retraining when performance degrades

- Create dashboards for business stakeholders

- Explainability and Trust:

- Generate customer profiles to help the business understand who’s likely to churn

- Create actionable insights for customer retention strategies

- Measure model against arbitrary biases.

- Scalability:

- Optimize prediction latency for real-time applications

- Implement batch prediction capabilities for large customer cohorts

- Design the system to handle growing data volumes

As we can surmise, there is considerable effort to take a model to production. Bringing my experience as a full-stack software engineer, I would leverage AI in the step-by-step develop where appropriate to accelerate business value.